Tools for Sellers FAQs

Selling for Charity Questions

Here are answers to some commonly asked questions about eBay for Charity.

I am listing items on behalf of a charity. Do I need to do anything differently?

If you are listing items on eBay on behalf of a charity, either as an employee or an authorized agent, you are considered a “Direct Seller.” When you list an item and select that charity, eBay will automatically choose 100% as the donation percentage and the proceeds from the sale will go directly to the charity. Make sure that the charity administrator adds your account to their Direct Seller list. Learn more about getting your account set up as a Direct Seller.

How do I add charity to my listings?

- On your eBay listing, select the option to “Donate a portion to Charity”

- Select a charity from the list of options or search for another charity

- Select the percentage (10-100 percent) of your selling price that you would like to donate

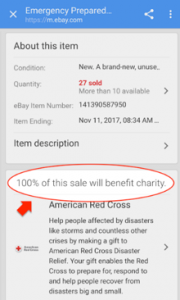

- Verify the charity and donation percentage on your item by checking the information included in the item description

- List your item and wait for it to sell!

How do charity listing fee credits work?

When you create a listing with eBay for Charity and that item sells, eBay will credit the Insertion and Final Value Fees back to you, equal to the percentage of the final sale price that you elected to donate. Advanced listing upgrade fees aren’t included in these credits. Here’s an example:

| Sale Total | Fees | Donation | Credit |

| Item’s Selling Price = $100 Shipping = $10 Total Cost = $110 |

Insertion Fee = $0.30 Final Value Fee = $10 Final Value Fee on Shipping = $1 Total Basic Selling Fees = $11.30 |

Donation Percentage = 50% | Insertion Fee Credit = 50% x $0.30 = $0.15 Final Value Fee Credit = 50% x $10 = $5 Final Value Fee on Shipping Credit = 50% x $1 = $0.50 Total Basic Selling Fees Credited = $5.65 |

Note: Other credits may be issued for impacted sellers in Service Metrics with a ‘Very High’ rating for Item Not as Described returns. See Service Metrics Policy for more information. Learn more about selling fees in our Customer Service center.

Are Insertion or Advanced Upgrade fees charged for charity listings?

Yes, Insertion and Advanced Upgrade fees will be charged for charity listings even if the item does not sell. However, for those listings that sell, we’ll credit the Insertion and Final Value fees equal to the percentage you donate. For example, donate 50% of your listing proceeds toward the charity listed and you will get 50% of the Insertion and Final Value fees credited. Advanced listing upgrade fees aren’t included in these credits. Learn more about selling fees.

How do I add, change or remove the charity on my listing?

Use the “revise listing” tools in the selling section of ebay.com to make changes. You can add, change, or remove a charity, or adjust the donation percentage on your active listing as long as your auction item has no bids or your fixed price item has no pending transactions or offers.

Why can’t I change the charity or donation percentage on my item?

You cannot make any changes to the charity or the donation percentage if your active listing has bids or your fixed price item has pending transactions or offers.

Why was my charity listing removed?

There are many reasons that a listing might be removed. See the original email you were sent or contact customer service to find out why. There are two charity-specific reasons that typically apply:

- The charity may ask eBay to remove an item listed on their behalf

- The charity’s account has been closed by the PayPal Giving Fund

Are there any item or category restrictions for charity listings?

Yes, there are some limitations on what items and categories can be included in an eBay for Charity listing. The “Mature Audiences” category may not be used and offering items such as raffle or lottery tickets is prohibited. For a complete list, please go to Rules about Prohibited and Restricted Items.

Also, the nonprofit that you select has the right to request an item cancellation if they prefer not to be associated with your listing.

Donations and Payments

What should I expect after my charity item has sold?

After your item has sold and you’ve been paid by the buyer, ship the item as quickly as possible. eBay will schedule the donation payment which you will find on your Donation Account Dashboard. The donation will be collected about 21 days after it sells to ensure that the transaction with the buyer is complete.

Make sure that you have set up a charity payment method.

Your charity donation payment method is used to collect donations from your completed eBay charity sales. Since donations are paid directly to the PayPal Giving Fund, the donation payment method must be a PayPal account.

First, check your Charity Donation settings to see if there is already a PayPal account set up for charity donations. You can add or edit your charity payment method from your Donation Dashboard on the Settings tab.

What if the buyer doesn’t pay or returns the item?

We will not collect the charity donation until the buyer has paid. If a return is completed before we collect the donation, the donation will be automatically canceled.

If your donation was already collected by PayPal Giving Fund, you can request a refund from the PayPal Giving Fund Community Care Team. If your donation has been delivered to the charity by the PayPal Giving Fund then you will need to contact the charity directly to request a refund

You can check the status of your outstanding donation payments and pay your invoices from your Donation Account Dashboard.

How and when will my donations be paid to the charity?

Our charity partner, PayPal Giving Fund, automatically collects* donations approximately 21 days after your item sells. When possible, we use the same PayPal account added as your automatic payment method for seller fees as your charity payment method. Once successfully collected, you will receive an email from PayPal indicating that your donation has been collected which is your official tax receipt as well.

The PayPal Giving Fund then combines donations received from eBay sellers from the 16th of the previous month to the 15th of the current month and then delivers a single donation to the charity’s PayPal account. For example, if a donation is paid on the 10th of October, the donation will be delivered to the charity at the end of October. However, if a donation is paid on the 20th of October, the donation will be delivered to the charity at the end of November.

*If your donation cannot be collected automatically then you will be emailed an invoice from PayPal Giving Fund requesting payment for the donation. You can pay these invoices with credit card, PayPal, bankcard or other supported payment types.

What is the PayPal Giving Fund?

PayPal Giving Fund (PPGF) is a registered non-profit that connects donors, businesses & charities in order to help charities raise new funds. eBay for Charity works directly with the PayPal Giving Fund to enable sellers to donate a portion of their sales and buyers to shop while supporting their favorite charity.

Thanks to operating support from PayPal, 100% of every donation processed by PayPal Giving Fund reaches the donor’s chosen charity organization. And because PayPal Giving Fund is a nonprofit itself, 100% of your donation amount is tax deductible to the extent allowed by law.

PayPal Giving Fund also certifies the charity, provides donation and donor reports, issues tax receipts, aggregates donations for monthly electronic distribution, and handles legal registration requirements. Learn more about PayPal Giving Fund.

Why am I being invoiced from PayPal Giving Fund?

eBay for Charity has partnered with the PayPal Giving Fund to collect donations from eBay sellers and deliver them to the charity. If your donation cannot be collected automatically then you will receive an invoice payable to the PayPal Giving Fund requesting payment for the donations due. You can pay these invoices with credit card, PayPal, bankcard or other supported payment types. You can check to see if you have a charity payment method from your Donation Dashboard on the Settings tab.

I deleted the invoice email from PayPal, how can I pay my invoice?

You can check the status of your outstanding donation payments and pay your invoices from your Donation Account Dashboard.

What do I need to do to make sure that my donation can be automatically collected?

First, check your Charity Donation settings to see if there is already a PayPal account set up for charity donations. You can add or edit your charity payment method from your Donation Dashboard on the Settings tab.

Why do you wait 21 days to collect my donation? Can I pay it sooner?

We wait 21 days to collect the donations to ensure that the transaction between you and the buyer is completed including payment, shipping, refunds, or returns. If the buyer doesn’t pay or returns the item then the donation will be canceled.

If you would like to pay your donation sooner, you can do so by requesting an invoice from your Donation Account Dashboard and pay the invoice immediately.

Can I pay my donation directly to the Charity instead of paying PayPal Giving Fund?

Donations must be paid through PayPal Giving Fund to be tracked properly. If you pay the charity directly, your donation will appear as “outstanding” and your eBay account may be restricted from listing items that benefit charity. All outstanding donation payments and invoices can be found on your Donation Account Dashboard.

What happens if I have not set up a charity payment method yet?

You will receive an invoice from PayPal Giving Fund requesting payment for the donation amount approximately 21 days after your item has sold. You can pay these invoices with credit card, PayPal, bankcard, or other supported payment types. All your outstanding donation payments and invoices can be found on your Donation Account Dashboard.

If you would like to pay your donation sooner, you can request an invoice from your Donation Account Dashboard.

You can add a charity payment method from your Donation Dashboard on the Settings tab.

How can I change or remove my PayPal account from the charity donation method?

First, check your Charity Donation settings to verify which PayPal account is selected as your charity donation method. You cannot remove the PayPal account but you can add or change your charity payment method from your Donation Dashboard on the Settings tab.

Where can I find a summary of all the donations that I’ve made?

Go to the History tab of your Donation Account where you can select the desired year to see all the donations you made that year. You can export that information into an Excel table if you want to save or print the yearly summary for your records.

Get in Touch

Connect with other charity organizations and sellers in our community forum Connected for Good or email us.