Frequently Asked Questions

For Charitable Organisations

How can I tell if my eBay Seller account is set up correctly as a charity entity?

You can see if you’re set up correctly as a Charity Seller in My eBay. Go to the Account settings of My eBay and select the Business Information link under Personal Info.

How do I set up a new charity selling account?

If you are a charity organisation and have access to inventory that you want to sell on eBay, please follow the steps listed on this page.

If I'm a Charity seller, what are my selling fees?

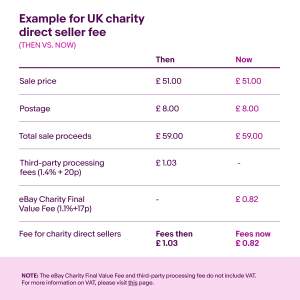

When you list and sell items on eBay, we charge selling fees. Once you’re activated on managed payments, we simply charge one final value fee when your item sells—and there are no third-party payment processing fees.

Once your charity status is verified, you will pay a final value fee at the special charity rate, calculated as 1.1% of your total amount of the sale, plus 17p per order. (The total amount of the sale is the entire amount the buyer pays, including any handling charges, the shipping service the buyer selects, sales tax, and any other applicable fees). If you’ve been notified to register for managed payments, please click here to find more information on all applicable fees and how they are calculated.

Here’s an example of how managed payments may work for you—your specific situation will vary.

An example of eBay’s managed payment fees:

Please note: In addition to Final Value Fees, you may also need to pay additional fees on eBay if you use any subscription services or optional listing upgrades. Visit our Selling fees help page for more information.

Why was I charged fees even though I'm set up as a Charity Seller?

Charities pay a final value fee at a special charity rate, with no third-party payment processing fees. Most charities’ fees should be lower overall than they were before. Your final value fee at a special charity rate will be 1.1% of your total amount of the sale, plus 17p per order.

Advanced listing upgrade fees such as reserve price or subtitle will be charged. Learn more about selling fees.

As a Charity Seller, when will payments for items sold be received in my charity's bank account?

Payouts are sent directly into the bank account set up for the charity. You can choose to schedule these daily as funds are available, or weekly. Regardless of how the buyer pays, payouts are consistently initiated Monday through Friday, within two (2) business days of order confirmation. Once a payout is initiated, funds will be available in your bank account within normal bank processing times, typically within 1–4 business days.

What documents or information do I need in order to register as a Charity Seller?

Keep the following information handy in order to register as a Charity Seller.

- Charity Information:

- Registered charity name, number, registered address, phone number, email, and website

- Charity mission statement, logo, donor and volunteer base, cause area

- Proof of charity registration and written constitution of the organisation (as applicable)

- Identity Information:

- Primary contact for the seller account (name, address, date of birth)

- Letter of authorisation for the primary contact signed by the trustee

- Trustees information (name, address, date of birth)

- Bank Information:

- Bank account registered to the charity (online banking access if available, account number, sort code)

Why do you need additional information from me?

All the information shared during registration allows us to send your payouts and comply with Anti-Money Laundering (AML) and know-your-customer (KYC) obligations, which helps keep eBay a trusted marketplace. Our data security procedures ensure that the information you share with us is safe. We will use and share the information you submit as described in the Payments Terms of Use. Learn more about how eBay protects your personal information in our Security Centre. For more information, please visit Managed Payments.

How does eBay use my ID information once verification is complete?

Our data security procedures ensure that the information you share with us is safe. We’ll use and share the information you submit as described in the Payments Terms of Use. Learn more about how eBay protects your personal information in our User Privacy Notice. For more information, please visit Managed Payments.

How do I make sure that my charity's selling account is set up correctly to accept buyer payments to our bank account?

When eBay manages your payments, your payouts will go directly to your bank account. eBay will deduct fees, expenses, and other selling costs directly from your payouts before they are sent to your bank account. You can track the status of your payouts in My eBay and in Seller Hub. You can schedule payouts at a frequency you choose (daily, as funds are available, or weekly). Regardless of how the buyer pays, eBay will initiate a payout within 2 business days of confirming the buyer’s order. Check eBay help pages for information on getting paid for items you sold.

Can I be a Charity Seller for multiple charities using the same account?

If your eBay account entity type is “charity,” you’ll only be able to sell for one charity using that specific account. If you are a Charity Seller for multiple charities, you’ll need to create a separate account for each organisation and register them as a charity.

What does it mean when eBay manages payments, and how does it affect charity sellers?

Managing payments is the way business is done on eBay, and it’s essential to enhancing the buying and selling experience on the marketplace. It offers sellers one place to sell and get paid. For buyers, it provides more payment options like credit/debit and gift cards, Apple Pay, Google Pay, PayPal, and PayPal Credit. Regardless of how the buyer pays, payouts are sent to your bank within 2 business days (Monday through Friday, excluding bank holidays) of confirming the buyer’s payment. You will also be able to download and export reports from Seller Hub. If you use third-party tools, there are no changes to how you use them. Those who integrate using eBay APIs can update their integrations to view payout information. Visit here for more information on managed payments.

Our charity has an active selling account. Can I set up a second selling account for our charity?

You can have multiple selling accounts for your charity. To ensure your account is set up correctly, please follow these steps:

Step 1: Gather Documentation

Make sure you have the following handy to expedite your enrolment:

- Charity Information:

- Registered charity name, number, registered address, phone number, email, and website

- Charity mission statement, logo, donor and volunteer base, cause area

- Proof of charity registration and written constitution of the organisation (as applicable)

- Identity Information:

- Primary contact for the seller account (name, address, date of birth)

- Letter of authorisation for the primary contact signed by the trustee

- Trustees information (name, address, date of birth)

- Bank Information:

- Bank account registered to the charity (online banking access if available, account number, sort code)

Step 2: Register for eBay’s Managed Payments

- Create an eBay business user ID for your charity’s designated seller

- Register on eBay as a charity seller

- Watch for a confirmation email

Step 3: That’s it! Start selling.

Once your information is verified within 3-5 business days, you’re good to start selling on eBay!

What will happen to my active listings when I migrate to managed payments?

When eBay manages your payments, all your existing listings and buyer feedback will be retained. Any listing without existing activity will be automatically updated to use eBay managed payments.

What reports are available on managed payments?

Once you are on the managed payments platform, you can download and export reports from the Seller Hub. Examples of reports include monthly statements, payout, order and post-transactions reports, and performance insights. The transaction report provides details of each transaction, including the fees. The payout report provides a reconciliation of all transactions that contributed to the daily payout into your bank account. Payout schedule can be set to daily or monthly through the Seller Hub.

Can I list on other countries' eBay sites such as eBay.com, eBay.au, etc.?

You may create listings on select eBay sites outside of the United Kingdom, such as the United States (www.ebay.com). We will continue to expand international selling to more countries in the near future. However, international buyers can still shop on eBay.co.uk if you ship internationally. For more details, click here.

Why did PayPal Giving Fund collect the donation from our charity PayPal account?

This can happen if your eBay selling account was not registered as a charity. You can see if you’re set up correctly as a Charity Seller in My eBay. Go to the Account section of My eBay and select the Business Information link under Personal Info. To get set up appropriately, you need to create an eBay business account and onboard as a charity following the steps listed on this page.

I'm selling on eBay for my charity. Why am I receiving invoices to pay donations?

This can happen if your eBay selling account was not registered as a charity. You can see if you’re set up correctly as a Charity Seller in My eBay. Go to the Account section of My eBay and select the Business Information link under Personal Info. To get set up appropriately, you need to create an eBay business account and onboard as a charity following the steps listed on this page.

For Community Sellers

I am listing items on behalf of a charity. Do I need to do anything differently?

If you are listing items on eBay on behalf of a charity, either as an employee or an authorised agent, you are considered a “Charity Seller”. When you list an item and select that charity, eBay will automatically choose 100% as the donation percentage and the proceeds from the sale will go directly to the charity. Learn more about getting your account set up as a Charity Seller.

How do I add charity to my listings?

In the listing flow, select the option to “Donate a portion to Charity.” Select a charity from the list of options or search for a different charity. Select the percentage you would like to donate to charity. You can verify the charity and donation percentage on your item by checking the information included in the item description. Note: The charity you select will be notified of your listing according to its account preferences and has the right to request an item cancellation if it prefers not to benefit from your listing.

How do charity listing fee credits work?

When you create a listing with eBay for Charity and that item sells, eBay will discount the variable portion of the Final Value Fees, equal to the percentage of the final sale price that you elected to donate. Insertion fee, per order fee and other fees aren’t included in the discount. Here’s an example:

Note: Other discounts may be issued for impacted sellers in Service Metrics with a “Very High” rating for Item Not as Described returns. See Service Metrics Policy for more information.

Are insertion or advanced upgrade fees charged for charity listings?

Yes, insertion and advanced upgrade fees will be charged for charity listings even if the item does not sell. However, for those listings that sell, we’ll discount the Final Value fees equal to the percentage you donate. For example, donate 50% of your listing proceeds toward the charity listed and you will get 50% of the Final Value fees discounted. Advanced listing upgrade fees aren’t included in these discounts. Learn more about selling fees

How do I add, change, or remove the charity on my listing?

Use the “revise listing” tools in the selling section of eBay.co.uk to make changes. You can add, change, or remove a charity, or adjust the donation percentage on your active listing as long as your auction item has no bids or your fixed price item has no pending transactions or offers.

Why can't I change the charity or donation percentage on my item?

You cannot make any changes to the charity or the donation percentage if your active listing has bids or your fixed price item has pending transactions or offers.

Why was my charity listing removed?

There are many reasons that a listing might be removed. See the original email you were sent or contact customer service to find out why. There are two charity-specific reasons that typically apply:

- The charity may ask eBay to remove an item listed on their behalf

- The charity’s account has been closed by the PayPal Giving Fund

Are there any item or category restrictions for charity listings?

Yes, there are some limitations on what items and categories can be included in an eBay for Charity listing. The “Mature Audiences” category may not be used and offering items such as raffle or lottery tickets is prohibited. For a complete list, please go to Rules about Prohibited and Restricted Items.

Also, the charity that you select has the right to request an item cancellation if they prefer not to be associated with your listing.

Donations and Payments

What should I expect after my charity item has sold?

After your item has sold and you’ve been paid by the buyer, ship the item as quickly as possible. eBay will schedule the donation payment which you will find on your Donation Account Dashboard. The donation will be collected about 21 days after it sells to ensure that the transaction with the buyer is complete.

Make sure that you have set up a charity payment method.

Your charity donation payment method is used to collect donations from your completed eBay charity sales. Since donations are paid directly to the PayPal Giving Fund, the donation payment method must be a PayPal account.

First, check your Charity Donation settings to see if there is already a PayPal account set up for charity donations. You can add or edit your charity payment method from your Donation Dashboard on the Settings tab.

What if the buyer doesn’t pay or returns the item?

We will not collect the charity donation until the buyer has paid. If a return is completed before we collect the donation, the donation will be automatically cancelled.

If your donation was already collected by PayPal Giving Fund, you can request a refund from the PayPal Giving Fund Community Care Team. If your donation has been delivered to the charity by the PayPal Giving Fund, then you will need to contact the charity directly to request a refund.

You can check the status of your outstanding donation payments and pay your invoices from your Donation Account Dashboard.

How and when will my donations be paid to the charity?

Our charity partner, PayPal Giving Fund, automatically collects* donations approximately 21 days after your item sells. When possible, we use the same PayPal account added as your automatic payment method for seller fees as your charity payment method. Once successfully collected, you will receive an email from PayPal indicating that your donation has been collected.

The PayPal Giving Fund then combines donations received from eBay sellers from the 16th of the previous month to the 15th of the current month and then delivers a single donation to the charity’s PayPal account. For example, if a donation is paid on the 10th of October, the donation will be delivered to the charity at the end of October. However, if a donation is paid on the 20th of October, the donation will be delivered to the charity at the end of November.

*If your donation cannot be collected automatically then you will be emailed an invoice from PayPal Giving Fund requesting payment for the donation. You can pay these invoices with credit card, PayPal, bankcard or other supported payment types.

What is the PayPal Giving Fund?

PayPal Giving Fund (PPGF) is a registered non-profit that connects donors, businesses & charities in order to help charities raise new funds. eBay for Charity works directly with the PayPal Giving Fund to enable sellers to donate a portion of their sales and buyers to shop while supporting their favourite charity.

eBay covers the cost of donation processing so 100% of every donation collected and transferred by PayPal Giving Fund reaches the donor’s chosen charity organization.

PayPal Giving Fund also certifies the charity, provides donation and donor reports, aggregates donations for monthly electronic distribution, and handles legal registration requirements. Learn more about PayPal Giving Fund.

Why am I being invoiced from PayPal Giving Fund?

eBay for Charity has partnered with the PayPal Giving Fund to collect donations from eBay sellers and deliver them to the charity. If your donation cannot be collected automatically then you will receive an invoice payable to the PayPal Giving Fund requesting payment for the donations due. You can pay these invoices with credit card, PayPal, bankcard or other supported payment types. You can check to see if you have a charity payment method from your Donation Dashboard on the Settings tab.

I deleted the invoice email from PayPal, how can I pay my invoice?

You can check the status of your outstanding donation payments and pay your invoices from your Donation Account Dashboard.

What do I need to do to make sure my donation can be automatically collected?

First, check your Charity Donation settings to see if there is already a PayPal account set up for charity donations. You can add or edit your charity payment method from your Donation Dashboard on the Settings tab.

Why do you wait 21 days to collect my donation? Can I pay it sooner?

We wait 21 days to collect the donations to ensure that the transaction between you and the buyer is completed including payment, shipping, refunds, or returns. If the buyer doesn’t pay or returns the item then the donation will be cancelled.

If you would like to pay your donation sooner, you can do so by requesting an invoice from your Donation Account Dashboard and pay the invoice immediately.

Can I pay my donation directly to the charity instead of paying PayPal Giving Fund?

Donations must be paid through PayPal Giving Fund to be tracked properly. If you pay the charity directly, your donation will appear as “outstanding” and your eBay account may be restricted from listing items that benefit charity. All outstanding donation payments and invoices can be found on your Donation Account Dashboard.

What happens if I have not set up a charity payment method?

You will receive an invoice from PayPal Giving Fund requesting payment for the donation amount approximately 21 days after your item has sold. You can pay these invoices with credit card, PayPal, bankcard, or other supported payment types. All your outstanding donation payments and invoices can be found on your Donation Account Dashboard.

If you would like to pay your donation sooner, you can request an invoice from your Donation Account Dashboard.

You can add a charity payment method from your Donation Dashboard on the Settings tab.

How can I change or remove my PayPal account from the charity donation method?

First, check your Charity Donation settings to verify which PayPal account is selected as your charity donation method. You cannot remove the PayPal account, but you can add or change your charity payment method from your Donation Dashboard on the Settings tab.

Where can I find a summary of all the donations that I’ve made?

Go to the History tab of your Donation Account where you can select the desired year to see all the donations you made that year. You can export that information into an Excel table if you want to save or print the yearly summary for your records.

General Overview Topics

What is eBay for Charity?

eBay for Charity is a program that helps the eBay community support the causes they care about when they buy and sell. Charity organisations can also sell donated or unwanted items on eBay to help support their programs.

How can buyers support charity on eBay?

eBay buyers can donate to their favourite charities in the following ways:

- Buy items from sellers committed to donating all or part of the proceeds to a charity. Look for the charity ribbon icon in the item description when browsing for items, or browse all listings from your favourite charity in the Charity Shop.

- Donate to your favourite charity at checkout. Browse for your preferred charities and select them as your favourites, then every time you pay for items on eBay you’ll have the option to also make a donation to a favourite charity.

- Donate directly with the Donate Now button. Find your favourite charity through the Charity Search on eBay for Charity, then donate your chosen amount through PayPal.

How can sellers support charity on eBay?

eBay for Charity has partnered with the PayPal Giving Fund to make it easy for sellers to donate some or all the proceeds from eBay listings to their favourite charities.

As a seller you can donate up to 100% of your final sales price to support your chosen charities. You can customise the donation percentage and the charity you want to support for each individual listing. The minimum donation amount is 10% or £1 (or 1% for eBay Motors listings).

When your item sells, you don’t have to do anything. Three weeks after the sale, if you have an automatic donation payment method on file, PayPal Giving Fund will automatically collect the donation from you. If you don’t have an automatic donation payment method on file, you will receive an invoice to pay your donation. You can see paid and pending donations on your donation dashboard.

When you designate a charity in your listings, the organisation’s logo and description will appear in your listing description, and the charity is notified of the listing’s creation. The organisation can request to have the listing cancelled if they prefer not to be associated with the listing.

Charitable fundraising is a highly regulated area, so be sure to read the Charity listings policy for specific guidelines on listing items that benefit charitable organisations. There are some category restrictions for charity listings. For example, you can’t list eBay for Charity items in the Adult Only or Real Estate categories, and you can’t list items that aren’t allowed on eBay. See our article on prohibited and restricted items for more details.

Fees and fee credits for charity listings

When you create a listing with eBay that supports charity and that item sells, eBay will discount the Final Value Fees back to you, equal to the percentage of the final sale price that you elected to donate up to 100%. For example, if you donate 30% of the final sales price to your chosen charity, you’ll receive a 30% discount on the final value fees.

There will be no additional third-party processing fee. All other fees still apply and do not qualify for a credit. Please refer to our selling fees help pages for more information on fees.

See eBay for Charity: For Sellers for more information about selling to benefit charities.

How can charities participate in eBay for Charity?

Charities can participate in eBay for Charity in the following ways:

- If you are a charity organisation that has access to inventory, you can register a selling account and sell items on eBay. Charity Sellers pay a final value fee at a special charity rate, calculated as 1.1% of your total amount of the sale, plus 17p per order. Visit the eBay for Charity website for more information on how to register a selling account for your charity.

- Boost your fundraising potential by setting up your charity to receive donations from eBay buyers and sellers. We partner with PayPal Giving Fund to help ensure every pound collected on your behalf from eBay buyers and sellers goes to you as unrestricted funds. Visit Become an eBay Charity for more information on how to benefit from eBay Community Donations.

- Encourage your supporters to add your organisation as a Favourite charity on eBay. The eBay community can search for preferred charities and select them as their favourite. Every charity that enrols with PayPal Giving Fund receives a Charity Profile page on eBay where supporters can choose to add them as a favourite charity. Visit our Charity Search to find your organisation’s profile page.

- Charities can create their own symbolic gifts on eBay using the Gifts That Give Back tool. Gifts that Give Back is a fundraising feature powered by eBay for Charity. It provides a way for Charity Sellers to raise money and awareness for their charitable causes by selling or auctioning symbolic gifts to buyers. Visit our Gifts That Give Back page for more information.

What is PayPal Giving Fund?

PayPal Giving Fund is a registered charity. In collaboration with PayPal, they’re building a network of donors, businesses, and charities to raise new, unrestricted funds for charity. Using digital technology and working with leading Internet businesses, they generate more than £100 million in donations each year to benefit charities in the UK, the US, and other countries. They provide donation and donor reports, aggregate donations for monthly electronic distribution, and handle legal registration requirements—all without charging donors or charities for their PayPal Giving Fund services.

Who can enrol in PayPal Giving Fund?

To enrol in PayPal Giving Fund, you need a confirmed PayPal charity account. Registered charities, religious organisations, and government agencies can provide documentation to PayPal to confirm their PayPal business account belongs to a charity.

Will I pay any fees when I receive donations through PayPal Giving Fund?

PayPal Giving Fund itself does not charge charities any fees for enroling or receiving donations.

When and how do charities get paid by PayPal Giving Fund?

PayPal Giving Fund distributes donations to charities at the end of each month, depositing a single payment into each charity’s PayPal account, to reduce accounting costs. They make every effort to deliver each donation to the charity the donor chooses. If there’s a problem delivering a donation, they contact the charity and try to resolve it. If they can’t resolve the problem after that, they may reassign the donation to a different charity. See the PayPal Giving Fund Donation Delivery Policy for more details.

Do eBay sellers and buyers need to enrol with PayPal Giving Fund?

No, sellers and buyers don’t need to enrol with PayPal Giving Fund. Their donations will be made to PayPal Giving Fund, which then grants funds to the recommended charities subject to PayPal Giving Fund’s Donation Delivery Policy.

Why do I need to confirm my charity's PayPal account before enroling with PayPal Giving Fund?

When you enrol in PayPal Giving Fund, they fundraise on your behalf. To build trust with donors and protect the quality of their partner programs, they use PayPal’s account confirmation process to verify that all organisations enroled in PayPal Giving Fund are legal.

How do I know if my PayPal business account has been confirmed as a charity account?

When you enrol in PayPal Giving Fund, they will let you know if you need to confirm your PayPal charity account. You can also check by logging in to your PayPal account. Select Profile from the menu at the top of the page, select Business setup, then select the Account setup tab. If your account is confirmed, it will say, “We’ve confirmed your charity.” If not, it will say, “Confirm your charity status.”

How do we track the donations we receive through PayPal Giving Fund?

You can track your donation details by logging in to your PayPal Giving Fund dashboard. Select Dashboard from the menu at the top of the page to view your Donation History and your Pending Donations. Select Activity from the same menu to view donation details.

Why doesn’t my charity appear on eBay’s list of charities?

Charities need to enrol with PayPal Giving Fund to appear on eBay for Charity in order to benefit from community donations. As a grant-giving charity, PayPal Giving Fund collects the funds donated by buyers and sellers on eBay and then passes those funds on to the charity selected by the donor. Within 48 hours of enroling with PayPal Giving Fund you’ll appear on eBay’s list of charities and be able to receive donations through eBay for Charity. Make sure you include your charity’s logo and mission statement during the PayPal Giving Fund enrolment. eBay for Charity requires this information in order to be included in the list of participating charities.

How will charities receive payouts from donations made by the eBay community?

If you are a charity organisation and want to receive donations from eBay buyers and sellers, please follow the steps listed on this page. Donations from eBay’s community are processed by our partner PayPal Giving Fund. Once a month, PayPal Giving Fund will collect and deliver 100% of all donations collected for charities, through the generosity of the eBay community. Your charity will receive these donations to your PayPal account.

Charities that sell on eBay will receive payments from items sold directly to their bank account.

How do I change my charity's profile and logo?

If you’ve migrated to managed payments, you can change your charity information such as your logo and mission statement by signing into your eBay account and clicking “Account” in My eBay. Once on the Account Settings page, click on “Business info,” and under “Business details” you’ll see the option to edit your charity information.

If you’ve not yet migrated to managed payments, you can make changes to your profile anytime by logging into your PayPal Giving Fund Account and selecting “Edit Profile” from your dashboard.

Get in Touch

Connect with other charity organisations and sellers

in our community forum or email us.